EVI2 from EVNext

World’s foremost expert intelligence on e-mobility innovations

For corporate and investors investing in the fast growing e-mobility domain, fortunes will be won (or lost) based on how well they are able to weave innovation into their business and entrepreneurial efforts.

But, with so many innovations taking place in the e-mobility domain, and given the diverse and complex nature of the overall industry ecosystem, getting a grasp of the impactful innovations is a very difficult task.

This is where EVI2 comes in - we provide you with an exceptional understanding and clarity of the innovations happening across the e-mobility value chain, and also provide strategic guidance on how specific business and investor segments can leverage and utilize these innovations for success.

Who will benefit from EVI2?

EVI2 will be of exceptional value to any company or firm keen on developing powerful strategies while investing in electric mobility innovations.

EVI2 will be of special value to the following stakeholders:

- Companies in the automobiles and auto components sectors keen on investing in electric mobility

- Companies in industries related to e-mobility - such as renewable energy, energy storage, logistics & transport, electrical/electronics and oil & gas industries

- Financial and corporate investors keen on investing in attractive innovations in the eclectic vehicles and e-mobility sectors

- Researchers and innovators from corporates and universities undertaking high-impact technical and business research in e-mobility

Read our free sample report here

Why is EVI2 different from other e-mobility reports and guides?

EVI2 is the only comprehensive compendium in the world focussed solely on the innovations happening along the entire electric mobility value chain.

What are the main sections in EVI2?

The EVI2has over 650 pages of content comprising intelligence, data and insights on EV and e-mobility innovations. Some of the prominent sections in the intelligence dossier include: See end of page for detailed listings

- Inputs on over 200 innovative companies

- Detailed profile of 100 innovative e-mobility startups from around the world

- A listing of an additional 100 e-mobility startups with high potential for growth

- 1000+ innovation examples

- In all, over 1000 examples of e-mobility innovations from around the world

- Innovations from 13 countries unique to their e-mobility interests and scope.

- Over a 100 product categories within e-mobility listed with interesting innovations.

- OEMs, Battery, BMS, Battery Recycling, Raw Materials, Testing, Design, Safety, Fleets, Finance etc.

- Innovations integrating over 15 different industries with e-mobility.

- Food & beverages, Textiles, Agriculture, Retail, Logistics, Construction, Hospitality, Tourism, Health care, Mass transportation, Residential Communities, Sports, Oil & Natural Gas, City Administrations, Armed Forces, Smart Grid, Information Technology, Circular Economy, Materials and Fintech.

- Answers to questions

- Detailed answers to over 30 critical questions on EV innovation and EV innovation strategy for all prominent stakeholder categories - OEMs, EV battery makers, EV charging solution providers, financial investors, researchers, auto component makers, companies in related industries such as renewable energy, logistics, electrical/electronics and more.

- Expert perspectives

- For every section in the intelligence dossier, we provide innovation perspectives from top global industry experts - corporate CEOs, leading management consultants, industry thought leaders, top tier research institutes and more.

- Exciting innovation factboxes

- Explaining 200+ attractive innovation highlights

- Answers to critical questions around innovation for key EV stakeholders

- Recommendations on EV innovations for key stakeholder groups

- Lithium and other battery materials processing

- Battery cell and pack manufacturing

- Other components of EV powertrains

- EV components other than powertrain

- EV design

- OEMs

- EV charging and battery swapping

- EV maintenance

- EV end of life

- Recommendations on EV innovations for key industry sectors

- EV & conventional automotive manufacturers

- Battery makers

- EV charging station or battery swapping service providers

- Financial investors

- IT industry

- City administration.

Insights and facts that will open your eyes to a comprehensive list of innovations taking place in the e-mobility sector

|

TESLA Innovation strategies & approaches that made Tesla a $700 billion car company |

TOP OEMs How the top 50 auto OEMs and auto component companies are using acquisition of startups as a key approach in their innovation strategies |

HYDROGEN/FUEL CELLS Why commercialization of innovation around hydrogen and fuel cells could happen far sooner than expected |

|

LOW TECH Why low-tech EV innovation could win over high-tech in developing and underdeveloped countries |

STARTUPS How smart startups are crossing the chasm of death on the way to commercializing their innovations |

UNIVERSITIES How the world’s top universities are forging partnerships with industry to leverage their research expertise in e-mobility |

|

INVESTORS Evaluation strategy used by top financial investors (VCs, PEs and corporate investors) in choosing the right innovations to back |

END USE BUSINESSES How select business end use sectors such as logistics and business fleets are innovating around attractive business models for EV adoption |

AUTO COMPONENT COS How all tiers of auto ancillary companies worldwide are strategizing around innovation in their efforts to diversify into electric mobility |

|

CHINA Why China’s EV innovation strategy is different from the growth strategies it adopted for other industries |

SOLAR POWER How innovations around use of solar power is being used as a strong differentiator for EV OEMs targeting select markets |

GOVERNMENTS How some of the large corporates are enabling their respective local and national governments to provide support to the right kind innovation that will be a win-win for many different stakeholders including themselves |

|

NICHES What are the various micro niches - and micro niche categories - available for startups and investors alike in the e-mobility ecosystem? |

MARKET INSIGHTS How smart companies worldwide are using unique insights of market needs to come up with low-investment, but high potential innovations |

BATTERIES How different companies are innovating differently at different components of the battery value chain |

Key questions answered by EVI2

EVI2 provides intelligence and recommendations for many specific target segments - categorized both on product and value chain segments. The compendium answers a range of critical questions in the minds of decision makers and senior professions in these segments. Some of the prominent questions that EVI2 answers in great detail are:

- What are the strategic and operational partnerships that 2 wheeler and 4 wheeler OEMs can explore to build strong competitive advantages for the B2C market?

- How can an entrepreneur or business identify attractive niche EV OEM segments?

- What are the key learnings on best of breed approaches from the e-mobility strategies of prominent OEMs?

- Which of the two - battery charging or swapping - will dominate in the future?

- How can a manufacturer of components for the ICE best strategize to pivot to the electric vehicle sector?

- For OEMs, what innovative design paradigms will lead to valuable differentiation?

- What are the attractive business opportunities available for software and information technology professionals in the emerging e-mobility landscape - especially using technologies such as Big Data/AI/ML/IoT?

- How can Li-ion battery pack makers differentiate their offerings to the OEM market?

- How can some of the key trends in industrial technology and mobility (additive manufacturing, automation/robotics, shared/connected/autonomous mobility) be leveraged by companies keen on providing differentiated offerings in the e-mobility space?

- What innovative opportunities does the e-mobility sector provide to companies in the renewable energy sector, specifically solar energy sector?

Innovation

- Identifying Opportunities around Key Innovations - Focussed research assistance that enables your company to identify attractive and innovative opportunities, as well as identifying and analyzing companies that are attractive for investments or acquisitions.

Analysis

- Strategic Analysis of Sector - Analysis of the overall electric mobility sector - or sub-sectors such as batteries, power train, OEM, charging infrastructure - on key dimensions to provide the BIG picture for the top management

- Market Potential Analysis - Detailed analysis of a specific vertical within electric mobility on market dimensions such as Supply-demand, Market Potential, Competitors, Industry Characteristics and more…

- Value Chain/Supply Chain Analysis - A comprehensive supply chain analysis for specific EV vertical in order to identify both opportunities and constraints for growth

How was EVI2 developed?

- A team of 6 dedicated researchers, working for over 2 years

- Utilizing data, knowledge and insights that our consulting team had gathered in the e-mobility sector since 2016 through consulting assignments, reports and through organizing focussed events and workshops.

- Leveraging the significant strategic and sustainability consulting expertise and perspectives of the parent company, EAI which had assisted over 250 companies - including 25 Fortune 500 companies - in their sustainability efforts.

- Over 10,000 innovations analysed to shortlist the 1000+ impactful innovations identified along the entire e-mobility value chain.

Who is the team behind EVI2?

- The core research team behind this expert guide is from EVNext, a firm focussed on providing strategic insights on emerging innovations and trends in electric vehicles

- EVNext is the e-mobility division of EAI, a leading cleantech consulting firm that has been providing sustainability consulting to Indian and global firms since 2008.

- Since 2016, the e-mobility division has undertaken multiple efforts - through consulting and industry research - to add value to the e-mobility ecosystem

What is the geographical scope of EVI2?

The EVNext team has been researching technology and business trends in the global e-mobility sector since 2016. In addition, the team had organized many expert conferences and workshops in e-mobility during this period, some of these with international expert participation. All these activities have enabled our team to better understand global trends, challenges, drivers and innovations.

The EVI2 expert guide has been prepared with the global business stakeholders in mind and covers e-mobility innovations from over 50 countries including USA, UK, Germany, Italy, France, Spain, China, Brazil, South Korea, Japan, South Africa, India, Singapore, Australia, Israel and more.

Key takeaways

Based on the extensive research the EVI2 team undertook to study and analyse EV innovations - which are presented in this comprehensive guide - following are the key takeaways for the e-mobility innovation spectrum:

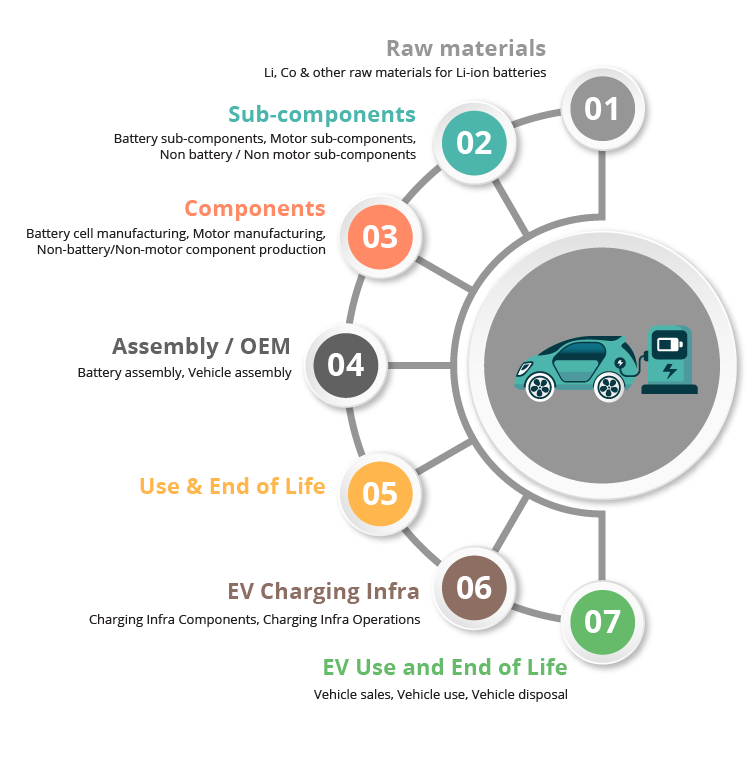

- Across value chain -Innovations are happening across the EV value chain, in every possible component. Even components that are considered commodities (electric cables and connectors, for instance) are seeing significant innovations that are aligned to relevant value propositions.

- Across products - In just the past few years (since 2017), electric vehicles have grown to far beyond just electric cars, bikes and scooters - and today , you have electric buses, electric vans, electric trucks and even electric aircraft. As of early 2021, our research counted no less than 30 different types of vehicles that have been electrified. Almost all these product categories - and their powertrain components such as batteries, BMS, motors - are seeing significant innovations. Going beyond batteries, hydrogen and fuel cells have also attracted innovator and investor interest. And going beyond just the use phase, innovations are also spurring progress in the end of life of both electric vehicles and batteries - especially in battery recycling, life extension, and in its second use as stationary storage devices.

- Use in multiple industries - In addition to the B2C sector, the more visible in the electric vehicle domain, the B2B sector too has started playing an increasingly important role. Electric vehicles are already finding use in over 20 different industries. So high is the interest for EVs in the B2B sector that this sector (rather than B2C) could be the real growth story for electric vehicles during the 2020-2030 period. Diverse innovations are taking place in the B2B EV space, many of which are being supported through large corporate investments in addition to funding from venture capital firms.

- Different genres of innovations - Innovations happening in the e-mobility sector are not just technology-oriented. Innovations in strategy, in business models and in financing are seeing exceptional activity as well. For instance, in parallel to technology advances are taking place in battery charging (both AC slow charging & DC fast charging), many startups are also offering unique EV battery swapping solutions, some of which are accompanied by impressive automation through the use of robotics.

- By different stakeholders - Transportation touches a wide variety of stakeholders, so it should not be any surprise that EV innovations are being driven by a large and diverse set of stakeholders. In addition to the obvious stakeholder sectors such as the OEMs and auto ancillary companies, our research has identified at least 10 other stakeholder segments significantly driving EV innovations (fleet owners, IT & software firms, solar power companies, venture capital firms etc.), and an additional 10 stakeholder segments who could be providing support for EV innovations in the near future - some of these stakeholders are unique in their diversification efforts and some could be quite surprising - national security and defense organizations, for instance.

- In different stages - The e-mobility phenomenon is quite new and is just beginning (EVs still have less than 1% penetration in most product categories), and innovations and inventions driving this sector are in their beginning stages too. A large portion of these innovations - some of which could prove disruptive - are in the pilot and even pre-pilot stages. In the context of EV innovations, one can confidently say that what the commercial world is seeing today is the proverbial tip of the iceberg.

- Strategic intent - While some innovations are taking place with specific end applications or unique value propositions in mind, some - especially those by large firms - are driven by long term strategies, and these innovations and their characteristics are quite nuanced.

- Different approaches - Depending on the stakeholder segments and their objectives, innovations in the EV space are witnessing different approaches. For instance, while there are hundreds of new startups putting in solo efforts to come up with innovative products, stakeholders such as governments or large auto OEMs are forming a web of diverse partnerships in their innovation efforts. While some of these approaches - OEM partnerships with EV charging networks or acquisition of innovative startups by large firms - are unsurprising, some are innovative and perhaps unique to the e-mobility sector.

- Across countries -Most EV innovations that come under the limelight are high-tech ones those developed countries that are auto majors - USA, Germany, Italy, South Korea, China etc. Innovations in the e-mobility spectrum are becoming increasingly commonplace even in underdeveloped countries in Africa. Interestingly, the nature of innovation is significantly different when one compares developed (USA. Germany etc.), developing (India, Kenya, Philippines etc.) and underdeveloped (many African nations) countries. While developed countries have a dominant focus on technology as the key component in their innovation, many underdeveloped countries are in fact deliberately using low-tech.to drive innovations.

- Order in chaos - If one were to look at the overall innovation spectrum in e-mobility across the globe, it appears chaotic. Large firms seem to be doing everything - acquisitions, partnerships and diversification into seemingly unrelated components of e-mobility. Startups of course are relatively more focussed but there are too many of them seemingly doing too many different things. Seen together, the overall picture appears like a complex maze. But if one looks closely, one will see logical strategies and clearly emerging trends in various stakeholder categories.

- Winning through innovation -For companies investing in electric vehicles - whether as a logical extension of their current business or as a diversification - innovation has to be a necessary component of their strategy. But innovation alone is not sufficient. What is also important is a robust approach to innovation. Such an approach will require the firm to review the above aspects and weave the relevant ones into their innovation strategy to create a sustainable competitive advantage.

How can you know more about EVI2?

To obtain a sample of EVI2 or to know more about purchasing it, please send a note to evi2@evnext.in

Read our free sample report here

Who have we assisted?

Since 2008, EAI has been at the forefront of cleantech and sustainability consulting and research. Our management consulting and industry research has spanned the entire cleantech spectrum but with higher emphasis on solar power, e-mobility and the bio-energy sectors.

Our consulting and research reports have benefitted over 3000 clients globally, including 10 of the top Fortune 25 companies and 40 of the top Fortune 100 companies. Our consulting team has had the privilege of assisting some of the globally prominent companies and organizations such as GE, GSK, Exxon Mobil, Toyota, World Bank, Bill & Melinda Foundation, among others.

More about EVNext from www.evnext.in . More about EAI from www.eai.in

Price of EVI2

$1950 for one copy

Special rates available for multiple copies or for large network distributions among corporates

To purchase EVI2, please send a note to evi2@evnext.in

Some of our Clients

Detailed listings

- Intelligence on the Innovative technology and Business models from a 100 startups from all round the world. Explained in detail of each company’s products, plans, partnerships, founders among other key knowledge parameters.

- Observe how unique innovations are well suited for different countries.

- Learn how innovations in e mobility are intertwined with numerous other industries.

- Breakdown of the electric mobility industry into its core and elemental sections giving an idea of all the stakeholders within the industry and the best innovations brought out in each of them.

- We have used our extensive knowledge and experience in the field to give Recommendations for various stakeholders.

- We extend our analysis to provide Recommendations for various components of the value chain

- Alternatives for lithium

- Cell chemistry

- BMS

- Analytics

- Battery pack casting

- Motors

- Motor controllers

- Regenerative braking

- Chassis

- Tires

- Seats

- Spatial advantages

- Charging and/or

- swapping advantages

- Renewable energy

- integration

- Lightweighting

- Bicycles

- Three wheelers

- Mass market cars

- Prernum and

- luxury cars

- Trucks

- Boats

- Planes

- Industrial use

- vehicles

- Fuel cell vehicles

- Fast charging

- Power electronics

- Software

- Wireless charging

- Robotic swapping

- Telematics & Analytics

- Lead-acid battery recycling

- Li-ion battery recycling

- Li-ion battery use in stationary storage

| Addionics (Israel) | Clean Energy Global (Germany) | Govecs (Germany) | Nohms (United States) |

Scoot Networks (USA)

|

| AEV Robotics (Australia) | Cobe (Denmark) | Heart Aerospace (Sweden) | Nuvve Corporation (United States) |

Sea Bubbles (France)

|

| Agora Energy Technology (Vancouver) | Dox (USA) | Innolith (Germany) | Ono (Germany) |

SilverWing Aeronautic (Holland)

|

| Akkurate (Finland) | Duesenfeld (Germany) | Ion Storage Systems (India) | OnzeAuto (Netherlands) |

Skeleton Technologies (Germany)

|

| Akkuser (Finland) | E Zinc (Canada) | Lavelle Bikes (England) | Ossiaco (Canada) |

Sono motors (München, Bayern)

|

| AMPLY Power, Inc. (USA) | EasyMile (France) | Li-Cycle (Canada) | Otonomo (Israel) |

South 8 Technology (USA)

|

| Aquarius (Israel) | Electreon (Israel) | Lightyear (Netherlands) | Ottopia (Israel) |

Store Dot (Israel)

|

| Arrival (London, UK) | Electriphi (United States) | Lilac Solutions (United States) | Oxis Energy (United Kingdom) |

Talga Resources (Australia)

|

| Astrolabe Analytics (USA) | Electron (England) | Lilium Aviation (Germany) | Paramatters (USA) |

TankTwo (Finland)

|

| Aviloo (Austria) | Enevate (United States) | Lionano (USA) | Phinergy (Israel) |

Tevva (United Kingdom)

|

| Battrion (Switzerland) | Envision Solar (United States) | Lit Motors (USA) | Pipistrel Aircraft (Slovenia) |

Tiler (South Holland)

|

| Belltech Systems (USA) | EP Tender (France) | Lithion Recycling Inc., (Canada) | Pure Watercraft (USA) |

Turntide Technologies (USA)

|

| Bolliger Motors (United States) | ETF Mining Equipment (Slovenia) | Lithium Werks (Netherlands) | Recurrent (USA) |

TuSimple (United States)

|

| Brill Power (England) | Faradion (United Kingdom) | Local Motors (USA) | REE Automotive (Israel) |

Twaice (Germany)

|

| Calogy Solutions (Canada) | Feasible (Canada) | Lunaz Design (United Kingdom) | Rimac Automobili (Croatia) |

Uniti Electric Car (Lund, Skane County, Sweden)

|

| Carbon Three Sixty (United Kingdom) | Fisker (United States) | Meshcrafts (Norway) | ROCSYS (Zuid-Holland) |

Volocopter (Germany)

|

| Chakratec (Israel) | Free Wire Technologies (San Leandro, California) | Nawa Technologies (France) | Romeo Power Technologies (United States) |

Wiferion (Germany)

|

| Chargetrip (Netherlands) | GBatteries (Canada) | Nikola Motor Company (USA) | Salient Energy (Canada) | XEV (Italy) |

| YASA (United Kingdom) | ||||

| Countries | Key Organizations Mentioned |

| Australia | Jetcharge, ACE EV, Better Fleet, AGL |

| Canada | Enel X, ElectraMeccanica, Loop Energy, Lion Electric |

| France | Renault, Toyota, Citroen, Voltia |

| Germany | PSA group, SVOLT, Bosch, BASF, Skeleton Technologies |

| Italy | Fiat Chrysler, Maserati, Automobili Pininfarina, Enel |

| Israel | Phinergy, Epsilor, REE, Bird, Store Dot |

| India | IOC, Tata Motors, Renault, Husqvarna, Yulu |

| Japan | Panasonic, honda, ZF, Mitsubishi |

| Mexico | Didi, Beyond, Grin |

| Norway | Volvo, Ruter, ABB, Scania, ZapGo |

| South Korea | Hyundai, Geely, Renault-Samsung |

| Taiwan | Foxconn, Ahamani, Visedo, Xing mobility |

| United Kingdom | Arrival, Dpd, Tewa, Rolls-Royce, Cranfield |

| Textile Fabric and components recycling Sustainable materials for EVs | Food & Beverage Mobile cooking Delivery/Transportation |

| Retail Last-mile delivery Chargers network | Agriculture & Farming Autonomous tractors |

| Construction Electric construction vehicles | Logistics Logistics control via drones |

| Medical & Health care Emergency electric vehicles | Hospitality & Tourism Electric transportation vehicles Charging infrastructure at hotels Multipurpose electric vehicles for ambience maintenance |

| Residential Communities Residential charging services | Mass Transport Infrastructure Railroad and aircraft electrification Public charging infrastructure |

| Oil & Natural Gas Charging network at retail outlets | Sports Motorsports Sustainable infrastructure |

| Armed Forces Disaster management and rescue vehicles Reconnaissance vehicles | City & Local Administrations Public transportation City maintenance work vehicles Public EV infrastructure |

| Information Technology Artificial Intelligence General software IOT | Smart Grid V2X energy transfer Grid load balancing |

| Materials Sustainable/Bio-based materials Advanced technology materials | Circular Economy Recycling Repurposing |

| Fintech EV or battery leasing | |

| OEM

Retrofit electric bus innovation Autonornous EVs Electric aircraft Electric boats Electric buses Electric golf carts for use in micro- mobility Electric LCVs Electric motorbike Electric Off-road vehicles Electric Trucks Fuel cens based EVs Fully electric bicycle High-end electric cars, luxury and sports cars Hybrid electric bicycle Hybrid electric LCVs Retrofit electric buses Retrofit electric trucks Retrofitted electric cars Retrofitted electric 3 wheelers |

Other energy storage technologies

Other emerging EV battery technobgies Other emerging stcrage and charging EVs Battery and BMS Battery diagnostics Battery thermal management Capacitor based storage for EVs Ll battery anode Ll battery BMS Ll battery cathode Ll battery cell making machineryBattery Charging and Swapping Ll battery electrolyte |

Battery Charging and Swapping

Power electronics AC/DC charging stations AC charging stations Battery as a Service Components for EV battery swapping stations - robots etc Lithium battery Recycling and Second life Li.ion battery recycling Li-ion battery refurbishing for extending life use of second hand Li-ion batteries Raw Materials Lithium mining/sourcing |

| EV Testing, Training and Design

Testing and simulation solutons for battery design and production E-mobility training and education EV design solutions Safety EV safety solutions in emergencies such as fWe and accidents |

EV Fleets, Lease and Rentals

EV leasing EV renting / ride sharing EV fleet management solutions B2B electric fleets |

Others

EV service and maintenance Teletnatics for EVs EV as a service for B2B logistics EV Sales Cables, wires and connectors for EVs Electricals, cables and connectors for EV charging and swapping stations Eco-friendly seats, dashboards etc for EVs |

| EV & conventional auto

OEMs

Niche EVs and end user markets Hybrid vehicles Innovative financing Schemes EV as a service |

Battery Makers

Innovative partnerships upstream and downstream Maximizing the benefits from use of IT in batteries Innovating for fast charging Battery as a ser,'ice | EV charging

station/swapping service

providers

Fast charging |

| Financial Investors

Investing in future - fuel cells, solid state batteries Leasing, EV services for specific end use sectors such as corporate fleets Developing the EV operating system |

IT Industry

EV BMS Use Of IT for locating charging stations Simulations Battery Research Fleets |

City Administration |

| Lithium and other

battery materials

processing

|

Battery cell making

|

Battery pack making

|

Other components of ev powertrain

|

Components other than power train

|

| EV design

|

OEMs

|

EV charging and swapping technology manufacturers and service providers

|

EV maintenance

|

EV end of life usage and component recycling

|